******WARNING****** NSFB!!! NOT SAFE FOR BOOMERS**************

Starting a new discussion board on Investment talks that will drive the future. Tired of the trolling going on so if investments is your interest, here is my thread. This includes EV, AI and Self Drving. I would just advise you to IGNORE the boomers. They can't properly comment what they dont understand.

TAANG+M: Here are my recommendations. It all comes down to these stocks

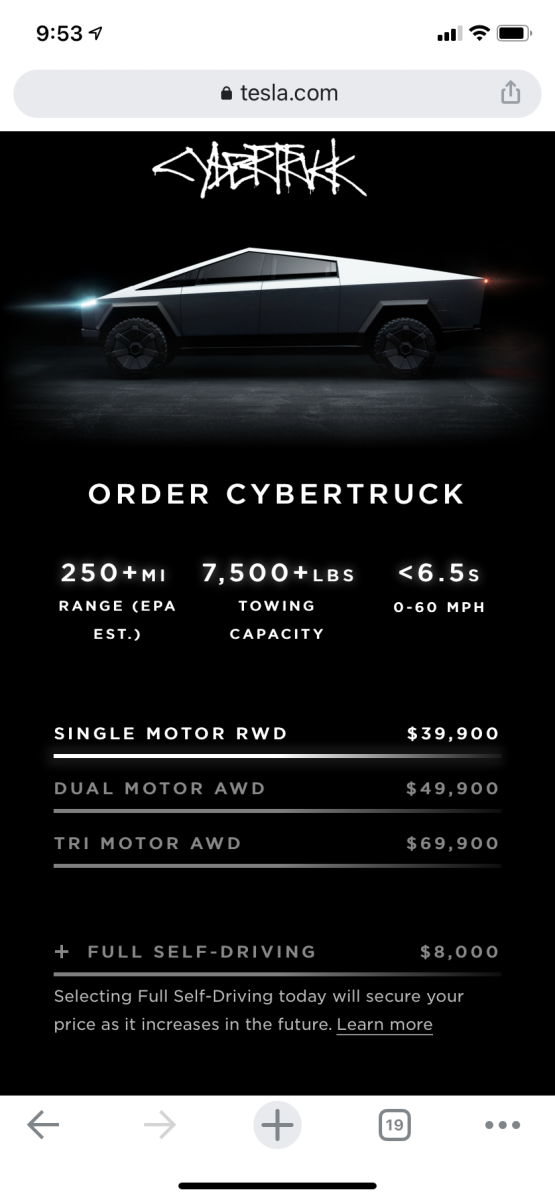

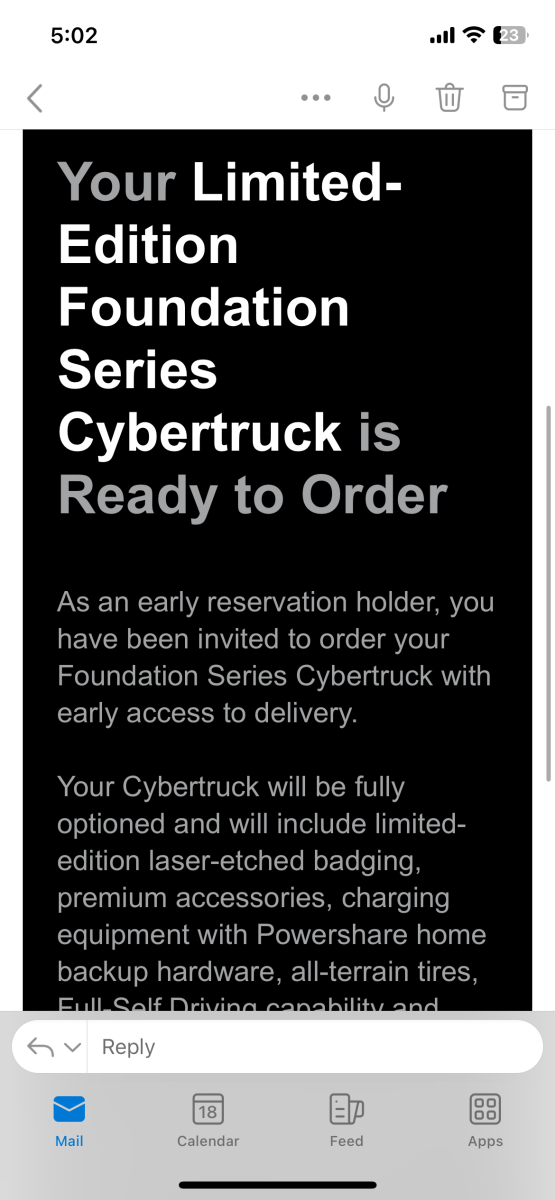

Tesla

Apple

Amazon

Nvidia

Google

+

Microsoft

AI will require more than just chips...

I would highly recommend at stocks that will use more and more computing software

1) Google

2) MSOFT

3) Tesla

Apple has literally thrown in the towels on two fronts:

1) AI chatbots. They have given into Gemini usage, which is owned by google

2) Self driving: Yes you heard it right. You need AI and machine learning, which is heavily favored and worked on by TESLA. If Apple truly pulled out of the robotaxi and self driving and cars altogether, this leaves TSLA as the only company ahead of its peers. A couple of years back, TESLA moved away from NVDA and started to make their own chips

Google's largest threat is AI. it's fair to say Google is the goto for search on the internet. Aside from the obvious, Google biggest threat is the fact that people stop using google search if they can just ask SIRI, Alexa, Chat GPT and AI for all things internet related. So they have vested interest in acquiring companies that are in the AI space and hiring the talent away to keep the threat at bay. So buy google while it is relatively cheap compared to its peers

MSFT offers suite of softwares that bridges into AI. For this reason, MSFT is a buy. It's clear MSFT owns the largest share of corporate america with it's softwares all loaded in user's hands. Outlook, word, excel, powerpoint, access, sharepoint, MS Teams. This is literally a monopoly. So I highly recommend you add MSFT to your holdings as no one will knock them off the pedestal

AMZN...They rule as we no longer can live without them. Amazon prime, prime movies, free shipping, cloud computing, storage and amzn web services. You gotta lock this in for the long term.

This is where I would park all my monies for the next foreseeable 20 to 30 years. A timeline that doesnt fit the boomer's threshold nor understand

And YES!!!! The Truck is THAT good. If you didnt get in one and drive one, I dont wanna hear about how terrible it is from those who havent been in one...have you ever considered the fact that you were never part of TESLA's marketshare?

Starting a new discussion board on Investment talks that will drive the future. Tired of the trolling going on so if investments is your interest, here is my thread. This includes EV, AI and Self Drving. I would just advise you to IGNORE the boomers. They can't properly comment what they dont understand.

TAANG+M: Here are my recommendations. It all comes down to these stocks

Tesla

Apple

Amazon

Nvidia

+

Microsoft

AI will require more than just chips...

I would highly recommend at stocks that will use more and more computing software

1) Google

2) MSOFT

3) Tesla

Apple has literally thrown in the towels on two fronts:

1) AI chatbots. They have given into Gemini usage, which is owned by google

2) Self driving: Yes you heard it right. You need AI and machine learning, which is heavily favored and worked on by TESLA. If Apple truly pulled out of the robotaxi and self driving and cars altogether, this leaves TSLA as the only company ahead of its peers. A couple of years back, TESLA moved away from NVDA and started to make their own chips

Google's largest threat is AI. it's fair to say Google is the goto for search on the internet. Aside from the obvious, Google biggest threat is the fact that people stop using google search if they can just ask SIRI, Alexa, Chat GPT and AI for all things internet related. So they have vested interest in acquiring companies that are in the AI space and hiring the talent away to keep the threat at bay. So buy google while it is relatively cheap compared to its peers

MSFT offers suite of softwares that bridges into AI. For this reason, MSFT is a buy. It's clear MSFT owns the largest share of corporate america with it's softwares all loaded in user's hands. Outlook, word, excel, powerpoint, access, sharepoint, MS Teams. This is literally a monopoly. So I highly recommend you add MSFT to your holdings as no one will knock them off the pedestal

AMZN...They rule as we no longer can live without them. Amazon prime, prime movies, free shipping, cloud computing, storage and amzn web services. You gotta lock this in for the long term.

This is where I would park all my monies for the next foreseeable 20 to 30 years. A timeline that doesnt fit the boomer's threshold nor understand

And YES!!!! The Truck is THAT good. If you didnt get in one and drive one, I dont wanna hear about how terrible it is from those who havent been in one...have you ever considered the fact that you were never part of TESLA's marketshare?