Highlights of changes for 2024. The contribution limit for employees who participate in 401(k), 403(b), and most 457 plans, as well as the federal government's Thrift Savings Plan is increased to $23,000, up from $22,500. The limit on annual contributions to an IRA increased to $7,000, up from $6,500.You also can do traditional IRA's for the both of you. I always did one on each of us for about $6500.00 each, in return my refund always paid for 1 of them nearly.

Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

-

ODT Gun Show & Swap Meet - May 4, 2024! - Click here for info

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tax Day

- Thread starter Allsmiles

- Start date

YepAnyone else making major changes to their tax planning this year after filing?

Highlights of changes for 2024. The contribution limit for employees who participate in 401(k), 403(b), and most 457 plans, as well as the federal government's Thrift Savings Plan is increased to $23,000, up from $22,500. The limit on annual contributions to an IRA increased to $7,000, up from $6,500.

Fun fact, there's an income limit on being able to contribute to a Roth IRA.

Traditional and Roth are two different animals.Fun fact, there's an income limit on being able to contribute to a Roth IRA.

Traditional IRA vs. Roth IRA: What you need to know

Traditional IRA vs. Roth IRA: What you need to know| Traditional IRA | Roth IRA | |

|---|---|---|

| Overview | This IRA offers you the potential to save on taxes upfront and defer them until you take distributions from the account. | This IRA helps you save for retirement with after-tax contributions that offer the potential for tax-free income in retirement. |

Fun fact, there's an income limit on being able to contribute to a Roth IRA.

Backdoor Roth IRA: Definition, Rules and How To Open One - NerdWallet

A backdoor Roth IRA lets you convert a traditional IRA into a Roth IRA, which could save on taxes. Backdoor Roths are an option if your income is too high for a Roth IRA.

I wouldn't wish that on anybodyWhat happens if you just don't do it? Serious question. Like for 2 years.

What you need is an other dependent.........**** them. I paid out.

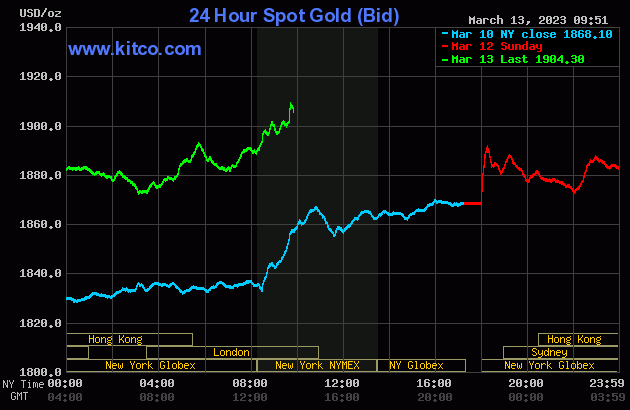

View attachment 7126178

That looks like filling up the RAV4 and Prius.**** them. I paid out.

View attachment 7126178

You'll get a hyper interest reward.........I thought tax day was October 15th

What you need is an other dependent.........

Right! 3 kids and a SAHW just wasn't enough.